What is accounting software application?

Accountancy software application is an application that records and reports a business’s financial purchases. Core modules of accountancy software program includes accounts payable and receivable, billing, as well as accounting. Non core components of bookkeeping software application might consist of financial debt collection, expenses, timesheets, acquisition reconciliation, payroll, and also reporting for every one of these. Bookkeeping software application is either cloud-based or desktop-based. The very best audit software application for small companies detailed right here is cloud-based.

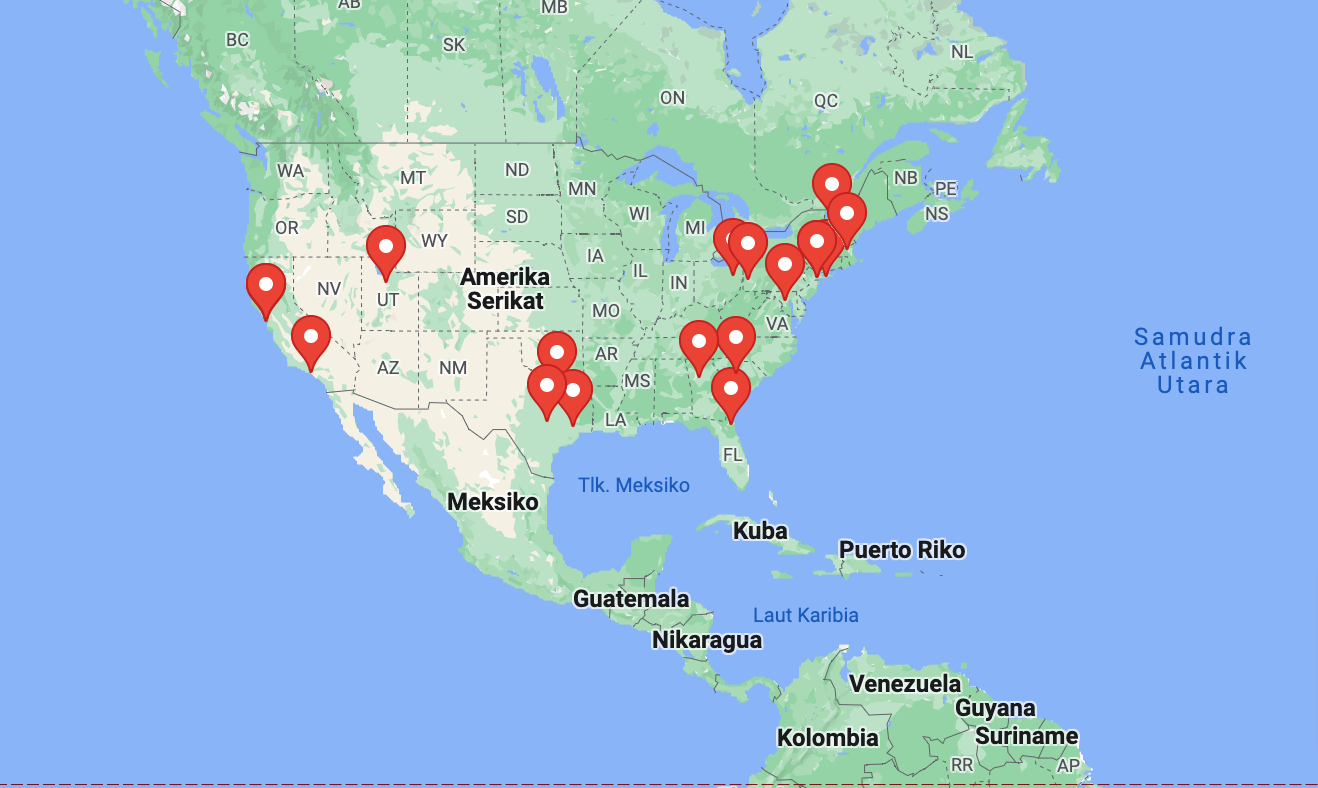

Finest Accountancy Software Program for Local Business in Friendsville, Garrett County – Best Accounting Software for Small Business

Finest Accountancy Software Program for Local Business in Friendsville, Garrett County – Best Accounting Software for Small Business

The 11 Finest Accountancy Software Program for Local Business in Friendsville, Garrett County 2022

- Best Overall: Intuit QuickBooks Online

- Best ERP Tools: Oracle Netsuite

- Best for Invoicing: FreshBooks

- Best for Microbusinesses: Zoho Books

- Best for Handling Accounts Payable: Melio

- Best for Online Merchants: GoDaddy

- Best for Growing Services: Xero

- Best for Transparent Pricing: ZarMoney

- Best for Automating Accounts Payable: Plooto

- Finest Free Accountancy Software Program: Wave Financial

- Best for Freelancers: Sage Business Cloud Accounting

Small companies that need basic invoicing and also reporting capabilities will do great with totally free or low-cost cloud-based bookkeeping software application. As your organization expands, you can include even more attributes and functionality.

Businesses that have a lot more complicated needs have a lot of choices for audit software. Your business’s certain needs will certainly determine which audit application is the best fit.

Businesses should seek audit software vendors that are transparent regarding their rates.

This short article is for business owners that are seeking audit and also invoicing software application.

When you start an organization, audit software application is one of the very first company applications you need to obtain. The very best bookkeeping software application assists you develop invoices, record incoming and outward bound repayments, recognize and follow up on past-due receivables, as well as run records that help you evaluate your economic health and also various other elements of your company.

To help you locate the very best accountancy software program for your organization, we took a look at greater than 100 applications. We tried to find budget friendly, easy-to-use audit programs with time-saving attributes, such as automated financial institution feeds, automated payment tips, and also on the internet invoicing as well as payment approval. We likewise searched for software with extensive, customizable, real-time monetary coverage, because that is vital for monitoring and also comprehending your business finances.

Right here are our ideal choices and information regarding our option procedure. Learn more concerning what you ought to seek in accounting software application by reading our audit software program price and also buyer’s guide.

OUR REVIEWS

Intuit QuickBooks Online: Ideal for Local Business in Friendsville, Garrett County

Editor’s score:

9,5

- QuickBooks Online has accountancy attributes to satisfy the requirements of companies of all sizes, consisting of the capacity to craft billings, send as well as accept payments, and handle and also track costs.

- QuickBooks' Real-time Bookkeeper offers professional help.

- If you have the independent strategy, you can not update to among the small business plans.

What can not QuickBooks do? The very preferred accounting software application is used by local business throughout the nation. Accountants fast to commend the application for its cost, ease of use and effectiveness. It’s hard to locate numerous flaws with QuickBooks, specifically considering the requirements of local business today. QuickBooks Online uses small company proprietors a feature-rich accountancy platform that incorporates with lots of organization applications and also does not cost a fortune. Many companies locate it useful to connect their bank card handling company to their accountancy software program to shut the loophole on their sales. We like that the software application is cloud-based as well as updated routinely.

We selected QuickBooks Online as our best choice for small businesses for numerous reasons. With this accounting software program, you can create specialist billings, approve payments, track expenses and also maintain a constant eye on your capital. Which’s simply with the Standard strategy; the higher-priced strategies let you send out batch invoices, take part in deep analytics as well as also accessibility a devoted accountancy group. QuickBooks Online integrates with numerous popular service apps, consisting of Bill.com, Salesforce and HubSpot.

With QuickBooks, you don’t have to produce economic records from the ground up, thanks to the software program’s integrated records, which include the trial equilibrium, general ledger and 1099 deal detail records you’ll need at tax time. You can note the reports you use most as favorites so you can swiftly locate them on top of the Reports web page. You can additionally establish the software application to instantly run and email reports to you, and arrange them for a specific time of day as well as frequency, such as daily, weekly, regular monthly or quarterly. QuickBooks offers several of the best reporting choices of any kind of audit software application we assessed.

For local business aiming to eliminate waiting on overdue invoices as well as wanting to get their cash immediately, QuickBooks individuals can use Earn money Upfront. This invoice program permits small companies to look for an upfront advancement of funds based upon one or more of their certifying billings. When a local business owner sends out a billing, they’ll have the alternative of accessing the funds early in the form of a development. As soon as authorized, 97% of the invoice will instantaneously be transferred in their checking account for an ahead of time 3% cost. The breakthrough can amount to $30,000 and is interest-free for the initial 1 month.

QuickBooks additionally gives some users the capacity to access a synced spreadsheet tool for Microsoft Excel. Spread sheet Sync reduces potential errors from manual data entrance and CSV imports. Individuals have the ability to attach their QuickBooks data with Master order to construct tailored reports and conduct bulk uploads as well as edits.

Another benefit of QuickBooks Online is its versatile assistance. Whether you are the do it yourself kind or prefer even more hands-on aid, QuickBooks supplies. With its Live Accounting service, you can get aid from an accountant who will certainly set up your software, classify transactions, resolve your accounts and also close your books month-to-month as well as annual. Also much better, you don’t obtain charged for services you do not require; the prices for Live Accounting relies on your needs.

If you currently have an accounting professional, it’s simple to work together with QuickBooks. The software application lets you give your accounting professional gain access to free of charge; all they need to do is approve the invite. You can get rid of gain access to anytime. QuickBooks provides all kinds of local business a ton of audit functions without breaking the financial institution, and also its online reputation and also adoption rate stand apart on the market.

Furthermore, Quickbooks offers a repayment gadget that makes it possible for small companies to accept card repayments on the move. Quickbooks also incorporates with DocuSign to allow company owner to sign quotes digitally.

Adhering to Intuit’s acquisition of the Mailchimp marketing system, you can currently use your Quickbooks information to produce fractional audiences in Mailchimp. Information including email address, name, purchase history, as well as more can be made use of to construct targeted advertising projects (note that you will certainly require a different Mailchimp account).

Oracle NetSuite Accounting Software: Ideal ERP Devices in Friendsville, Garrett County

Editor’s score:

8,5

- NetSuite offers a variety of functions, consisting of business source preparation tools.

- The software program focuses on automation, making it basic to send out as well as accumulate billings.

- The website isn't clear concerning rates, so you require to contact a sales representative to determine the price.

Oracle’s NetSuite is a wonderful selection for small company owners that intend to get a full image of their company while automating elements of audit. With this software application, you can manage all aspects of your service from one control panel, making NetSuite our choice for the best accounting software program with venture resource planning (ERP) tools.

NetSuite is a full-featured bookkeeping and ERP program geared toward businesses with more complex needs. You can make and obtain settlements, run a variety of records as well as handle taxes. NetSuite has welcomed automation, making it very easy to send out billings and also obtain payments, and it has robust tax obligation monitoring tools that sustain all money as well as currency exchange rate. If you have global sales, the software application immediately refines sales as well as repayments based on the neighborhood regulations you’re selling or operating in. There’s likewise an income acknowledgment management solution that helps entrepreneur meet audit standards as well as record economic outcomes promptly.

Capital administration is likewise easy thanks to a robust set of features that provide insight into your cash money, making it much easier to maximize money, control bank accounts as well as stay certified with guidelines as well as guidelines. NetSuite’s settlement management system centralizes payments, while the planning as well as budgeting features combine data to aid you prepare. It’s additionally easy to create spending plans as well as projections, prepare for what-if circumstances as well as run reports on many aspects of your company. To maintain you in control, NetSuite lets you established permissions.

NetSuite additionally has many ERP tools to manage funds, supply, manufacturing as well as the supply chain, and the ERP performance additionally assists you plan for the future. Because NetSuite includes a lot of features as well as devices, it’s difficult to obtain a precise price without reaching out to a NetSuite sales representative. There’s an on the internet kind you can fill in to establish a totally free presentation.

NetSuite might not make sense if you are self-employed or a microbusiness without complex needs. However if you call for a more alternative strategy to accountancy and intend to be able to spending plan, plan as well as forecast, NetSuite should have serious consideration.

FreshBooks Accounting Software: Best for Invoicing in Friendsville, Garrett County

Editor’s score:

9,0

- FreshBooks lets you easily craft billings, approve payments through invoices, track expenditures as well as send automated tips.

- You obtain a full collection of accountancy tools to do whatever from track time as well as expenditures to run monetary reports.

- If you require to include numerous employee, it can get pricey.

If you require to produce and send out invoices, it can be challenging to find a small business bookkeeping app that matches your demands. Some services stand out at invoicing but provide no bookkeeping features; others consist of solid audit services yet lack quality invoicing tools. FreshBooks, on the other hand, succeeds at both.

Although all accounting software have invoicing tools, FreshBooks is extremely easy to use, which is why we selected it as the most effective audit software for invoicing. The style is instinctive, as well as with simply a few clicks, you can include billable time and also expenses, tailor the look of the invoice, and also set up reoccuring billings, automatic payment pointers and late costs.

This bookkeeping software links to your financial institution, creates a number of records, tracks time and also aids you manage projects. As a benefit, FreshBooks allows you give clients the option to pay costs with billings, which speeds up the procedure of earning money. If you have customers that are late in paying bills, FreshBooks allows you gently push them via reminders as well as notifies when bills schedule or overdue. You’ll know when customers get and also open invoices with this accountancy software.

Past invoicing, there are a lot of other features of FreshBooks that made it among our best picks. For instance, you can track time spent on tasks, in addition to breeze images of invoices and also log them on the move. And also, the double-entry audit attributes guarantee you do not make mistakes that could throw off your journal. With automated checks as well as equilibriums, you can feel confident that your debits as well as credit reports will certainly cancel. This software program likewise incorporates with greater than 80 prominent organization applications to provide you a better of your service.

FreshBooks offers you all of the features small companies require in an accountancy as well as invoicing software program application. Although it’s not as detailed as some of the various other choices on the marketplace, FreshBooks supplies incredible value as accountancy software application with solid invoicing capabilities. The ability to incorporate bookkeeping software application devices as well as invoicing devices is rare, but FreshBooks gets the job done efficiently. For companies that don’t send out invoices, various other bookkeeping remedies make more sense, however consultants and project-based organizations will normally be drawn to the features and cost of FreshBooks.

Zoho Books Accounting Software: Ideal for Microbusinesses in Friendsville, Garrett County

Editor’s rating:

8,7

- Zoho Books has apps for preferred operating systems and tools-- including Apple, Android as well as Windows-- allowing you to send billings, resolve accounts, and also approve repayments on the go.

- Via Xero, you can track as well as manage expenses as well as vendor credit scores.

- Xero has a limitation of 5,000 purchases each month, which isn't sufficient for some businesses.

Microbusinesses require simple bookkeeping software program, and that’s where Zoho Books can be found in. Zoho Books supplies every one of the basic attributes that microbusinesses requirement, as well as innovative devices such as job invoicing and time tracking. It likewise has assimilations, so you can proceed utilizing the software program as your company grows. We chose Zoho Books as the most effective bookkeeping application for microbusinesses due to its simpleness as well as value.

With its Apple, Android and Windows mobile applications, Zoho Books makes it simple for entrepreneur to send invoices and also handle their publications on the move. There are also devoted apps for the Apple Watch and Android smartwatches. The ability to develop and also send out invoices from the app suggests that, as quickly as you finish a job, you can bill a customer, rather than waiting to return to the office.

When you utilize simple accountancy software, you do not want an obsolete user interface or features that are so standard you can not obtain essential company understandings from the information. That’s what makes Zoho Books stand apart: While the system is easy to use, it doesn’t lack functions, and the user interface is contemporary as well as smooth. It can also speed up numerous organization procedures using automation, which is a nice time-saving function.

You can establish recurring billings and also send automatic payment pointers, and if you link your repayment cpu with Zoho Books, you can accept settlements in billings. You can automate coverage, also; Zoho Books lets you schedule when to run reports and afterwards instantly emails them to you.

Another feature that sets Zoho Books apart from its rivals is the company’s client website, a web site your clients can check out to view invoices, make remarks and also pay online. This is a particularly useful function for services that work carefully with their customers on projects. If you desire feedback from your customers, you can set up the website to allow them to review your services.

Zoho likewise has its very own suite of integrated company apps, including consumer partnership monitoring (CRM) software application, e-mail advertising and marketing as well as social media sites marketing services, spread sheet editors, and also various other efficiency devices. Like its competitors, Zoho Books incorporates with third-party productivity applications as well as business services, consisting of Google apps, the Square point-of-sale (POS) system, a number of bank card processors, as well as tax solutions Tax1099 and also Avalara. It additionally has a Zapier assimilation, which permits you to link to greater than 1,000 third-party applications. With all those functions and services, it’s very easy to see why Zoho Books is our choice for the very best accounting software application for microbusinesses.

September 2021: Intending to help local business proprietors as they arise from the pandemic, Zoho made its Zoho Billing system cost-free to its clients. Along with sending out bills, the software program lets you track time, handle project invoicing, and also access greater than 30 features and also tools to assist you get paid and gather past-due costs.

Melio: Ideal Cost-free Accounts Payable Software Application in Friendsville, Garrett County

Editor’s score:

7,2

- It's free to make as well as accept payments from savings account.

- You can easily schedule and track settlements as well as control that has access to your accounts payable as well as receivables.

- Melio charges a 2.9% cost for charge card purchases.

Some business owners do not require complex accountancy software program. If you just require to send billings as well as obtain payments, you must seriously consider Melio. We chose this cost-free accounts payable software application as one of our ideal picks due to the fact that you can make and also approve payments, take care of costs and also incorporate with QuickBooks free of cost.

With this cloud-based software program, there’s on the house to make payments through a financial institution transfer, yet there is a 2.9% charge to pay by charge card. It’s totally free to approve settlements from customers by means of check or bank transfer.

Melio is also extremely easy to use. Adding suppliers to pay and arrange settlements fasts and user-friendly. Melio lets you get in a vendor’s information manually, post a data with that date or break an image of an invoice. You can welcome both interior users as well as accountants to use the software program and afterwards appoint roles as well as permissions, so you know who is accessing your info and also what they are making with it in all times.

We also such as that Melio helps you handle your cash flow much better. You can set approval controls for deals, therefore stopping you from overextending on your own or having a cash flow lack issue due to the fact that you paid a costs early.

Another reason we selected Melio as the very best accounts payable software program is its integration with QuickBooks, which is our ideal choice for small companies. Melio is outstanding as a stand-alone program, however its integration with QuickBooks makes it even more impressive. Via the combination, you obtain much deeper insight right into your cash flow, and the two-way syncing is quick and also easy.

Melio may not mark off all the boxes for industries that require a lot of complicated accounting features. But for small businesses that wish to handle accounts payable free of charge, Melio ought to be a top consideration.

GoDaddy Online Bookkeeping: Ideal for Online Merchants in Friendsville, Garrett County

Editor’s score:

7,7

- GoDaddy Online Bookkeeping integrates sales information from Amazon.com, Etsy and also PayPal. You can generate reports as well as make business choices based on real-time information.

- There are three prices plans that accommodate different-sized services and also merchants.

- GoDaddy Online Bookkeeping was made for single owners as well as minimal obligation business; larger businesses may need a program with even more accounting features.

The sales channels are obscuring for small company proprietors who have to manage both online as well as offline sales, which is why it is very important for those companies to have an audit program that can keep every one of those deals with each other. GoDaddy Online Bookkeeping stands out in that respect, thanks to integrations with markets such as Amazon.com, Etsy as well as PayPal; the convenience with which you can send billings and approve repayments; and the ability to run a multitude of reports. And also, you get every one of those features at a budget friendly cost, making GoDaddy Online Accounting our option for the best accounting software application for online merchants.

Online sellers require a great deal from their bookkeeping software application. Along with the typical functions, on the internet organizations need a way to arrange on the internet versus in-store sales. GoDaddy Online Accounting allows company owner to track all their data in one location. You can import your accounts from Amazon.com, eBay, Etsy and PayPal, as well as run a multitude of records to give you real-time data as well as deep insight as well as evaluation. Like the other audit software we examined, GoDaddy Online Accounting is cloud-based, which means there’s absolutely nothing to download and also you can check in from any type of internet-connected gadget.

In addition to on-line sales data combination, this audit software application has lots of features local business proprietors need, consisting of the capacity to send invoices and also price quotes, process payments using a smart phone, schedule repeating invoices, and track mileage and also time.

GoDaddy has three inexpensive pricing strategies. The basic strategy is $4.99 a month, the midtier plan is $9.99 a month as well as the premium strategy is $14.99 a month.

GoDaddy had sole owners as well as limited obligation companies in mind when producing this accounting software program, which is an additional reason we picked it as the very best bookkeeping software for online merchants. Online sellers that are simply starting out may have a terrific product they want to offer however not a lot of service and audit knowledge. GoDaddy’s accounting software program is straightforward to rise as well as running and also is really easy to use. There aren’t a great deal of complex includes that you’ll never ever make use of, but there are many helpful ones that will conserve you money and time.

Several of those beneficial devices include tax obligation features. GoDaddy immediately categorizes deals right into various internal revenue service tax obligation buckets, as well as tracks estimated tax payments that are due and sales tax your service collected. When it comes time to file with the internal revenue service, you’ll have all the information at the ready.

GoDaddy Online Accounting doesn’t have a lots of bells and whistles as well as an expensive price to go along with them, but it does have a lot of online-merchant-focused functions that make it attract attention. For online vendors that intend to systematize their online sales, send invoices, track expenses and also run reports, GoDaddy Online Accounting checks off all the boxes.

Xero: Finest for Growing Businesses in Friendsville, Garrett County

Editor’s score:

8,5

- Xero provides more than 700 application integrations to take care of all elements of your company.

- You obtain assistance through e-mail as well as live conversation 1 day a day.

- Xero isn't too called QuickBooks, which may affect your accountant's learning contour.

Although numerous companies start little, they don’t always stay this way. You desire accounting software application that can expand together with your organization, and Xero does specifically that.

Unlike accounting programs that base rates on the number of users each strategy supports, Xero’s registration plans sustain unlimited users. So, as your service grows, you can add brand-new staff members to your account at no added cost. All strategies consist of most functions, such as estimates, inventory monitoring and also recurring invoicing. The software supports greater than 700 app integrations, and also it features 24/7 e-mail and live chat assistance.

There’s an additional factor we selected Xero as the best audit software program for growing businesses: The pricing strategies were developed for various stages of a firm’s development. Xero has prepare for consultants, solo traders, local business owner just starting, much more well established small companies and even ventures.

Xero can run over 50 records, consisting of profit and also loss declarations and a general ledger. Xero individuals can now tailor their management record pack to include the most beneficial reports to them and their organization. The Xero HQ report templates have actually additionally been upgraded to align with the feel and look of various other standard Xero records. Lastly, Xero’s Executive Recap record supplies a lot more adaptability in regards to day ranges, comparative periods and also commentary message capacity. Once you’re done running a record, you have the option to publish it or export it as a PDF, Excel spreadsheet or Google Sheet.

Like various other accountancy software program, Xero lets you manage supply, which is exceptionally practical if your company sells as well as stocks a lot of items. You can track things in real time, monitor inventory and also area fads in your sales. With its recent purchase of LOCATE Supply, Xero is making it easier for individuals to automate inventory jobs, much better handle supply as well as demand, as well as enhance prices. Xero clients likewise have access to brand-new channels to sell their items.

Xero additionally gives mobile access via applications for the apple iphone, iPad as well as Apple Watch. This accounting software program is additionally easy to use, thanks to an interactive dashboard that informs info such as when invoices are due and which costs still need to be paid.

In addition to all that, you get project monitoring devices if you enroll in the Developed strategy. Using these devices, you can track tasks, expenses, budgets, billable time and settlements, along with collaborate with other individuals on particular jobs and also invoice consumers through the software.

Our company believe that Xero’s variety of functions, incorporated with its client support, makes it among the much better alternatives on the marketplace. When you include the mobile application, you get an excellent accounting software for expanding businesses.

ZarMoney: Best for Transparent Rates in Friendsville, Garrett County

Editor’s rating:

8,2

- The ZarMoney internet site plainly sets out prices.

- ZarMoney gets in touch with greater than 9,600 banks in the U.S. and also Canada to immediately import financial institution deals.

- You can't send out reoccuring billings yet.

With ZarMoney, there are no secrets concerning rates. The firm’s website states exactly how much you’ll pay monthly, which is why we chose it as our pick for the best accounting software program for clear prices. Much too often, it’s difficult to establish how much an accountancy program will cost, making it tough to comparison-shop. ZarMoney, by comparison, prides itself on being straightforward, which’s reflected in the clearly laid-out prices plans.

ZarMoney has easy prices plans tailored towards business owners, local business owners as well as ventures. The business owner strategy is $15 a month for one user as well as sustains unrestricted deals, as well as the small business strategy covers limitless deals and also 2 individuals for $20 a month. Each added individual on those plans costs $10 a month. For big organizations that want greater than 30 individuals, ZarMoney costs $350 a month. All strategies supply customer assistance in the united state

ZarMoney has a toolbar that reveals you just how much the software costs each month based on the variety of customers. We such as that you can include as well as get rid of customers based on your service’s current needs. If you add an additional customer, the account is automatically updated, conserving you time due to the fact that you do not have to call client service to make a modification.

ZarMoney includes lots of bookkeeping functions at an affordable price. With the software program’s balance dues remedies, you can take care of the standing of estimates as well as sales, accept online credit card settlements, as well as give various settlement terms and early-payment discounts. Soon, you will have the ability to send repeating billings.

ZarMoney connects with greater than 9,600 banks in the U.S. and Canada, which suggests there’s a likelihood it supports your financial institution. With these connections, ZarMoney automatically imports financial institution purchases daily for you to approve and/or modify. You can likewise make set deposits, calculate sales tax obligation as well as easily transfer funds.

Plooto: Ideal for Automating Accounts Payable Processes in Friendsville, Garrett County

Editor’s rating:

7,7

- Plooto's settlement platform lets you manage repayments, approvals, reconciliation and also reporting from one central place.

- The software gives accounts payable and also accounts receivable automation, speeding up settlements.

- Plooto syncs with only QuickBooks as well as Xero, which could be limiting.

Most local business are ground for time, so anything they can automate is welcome. Plooto provides small businesses a great deal of that for an affordable price, which is why we selected it as the most effective bookkeeping software program for automating accounts payable processes.

Plooto is a payment platform that allows local business to manage their repayments in one central place, therefore offering company owner a clear picture of their financials and more control over them. Settlements, authorizations, reconciliation and also coverage are unified under one control panel.

The software consists of wise authorization operations and also protected electronic repayments, which lower errors and speed up the accounts payable procedure. On top of that, Plooto supplies organization accounts payable and accounts receivable automation, which aids small businesses collect on past-due costs.

While lots of settlement platforms supply comparable attributes, Plooto sticks out for offering an economical way to automate all accounts payable tasks. You can utilize the exact same system to pay all vendors, even if they lie outside the united state, along with add payees in seconds, either by browsing Plooto’s network of 120,000 vendors and also suppliers or by adding them manually.

Plooto also accelerates repayments by automating invoicing and enabling you to accept repayments within billings. Once a customer pays, the repayment is automatically reconciled. One more plus is that Plooto incorporates with QuickBooks and Xero, 2 popular audit programs, offering you more clear records of repayments, audit tracks as well as simpler settlement. You can pay electronically or via contact the combinations, along with make batch settlements, search records and set repayment authorizations.

When it pertains to handling receivables, you desire a program that is easy to use, budget friendly and transparent. Plooto checks off all those boxes, which is one more factor it made our checklist of best choices. Plooto costs $25 a month for 10 domestic payments and 50 cents for every added domestic deal. Each worldwide purchase costs $9.99, and each check settlement is $1.99. There are no constraints on the variety of customers, approvers, consumers, vendors or bank links, and also there is on the house for an accounting professional to work together. Plooto recently added the ability to accept charge card repayments by means of its Bank card Acceptance offering. This quicken the moment it takes to make money. In most cases, this solution can obtain cash right into your checking account in simply 2 business days. Plooto charges 2.9% + $0.30 per transaction.

Plooto is a good option for small companies that need a budget friendly way to enhance their accounts payable and also accounts receivable as well as conserve time. It likewise sticks out for its automation and assimilations with QuickBooks and Xero, making it excellent accounting software program for local business owner that work with those accounting plans.

Wave Financial: Best Complimentary Choice in Friendsville, Garrett County

Editor’s rating:

8,0

- Swing links with bank accounts as well as charge card, so you can track expenses immediately.

- Wave provides you typical bookkeeping solutions totally free.

- Wave's assimilations are a lot more restricted than a few of its rivals.

Wave Financial uses several important, quality accounting functions free of charge. It attaches to your bank accounts in real time, as well as uses payroll and invoicing attributes as well as limitless accounting professional links. Those are just a few of the reasons we picked Wave as our pick for the very best totally free bookkeeping software program.

With Wave, you do not have to worry about monthly or annual fees, nor do you have to accredit software. Wave is totally cost-free unless you choose optional attachments. That means that, if you want to send out billings, run records and also integrate with popular service apps, you do not need to pay a penny. There are no restrictions on the number of purchases, invoices you send and customers that access your Wave account. If you want to accept billing repayments, Wave bills a flat rate of 2.9% plus 30 cents per credit card deal. For ACH bank transfers, Wave fees 1%, and also there’s a $1 minimum cost. The company additionally has additional payroll and bookkeeping solutions that business owners can access for a fee.

Swing conveniently holds its own when compared with paid audit software application. This program automates many elements of accounting, therefore conserving business owners priceless time. Through the cloud-based bookkeeping program, you can develop as well as arrange reoccuring invoices and also repayments, in addition to set up automated payment suggestions and also automatic syncing with your financial institution, bank card and PayPal accounts.

Wave’s reporting abilities additionally stand out. You could believe a free accountancy application would not have lots of reporting attributes, yet that’s not real of Wave. You can run loads of reports on every little thing from capital to earnings and also losses, as well as track costs and also upload receipt images. Wave incorporates with Etsy, PayPal, Shoeboxed as well as Zapier, which offers you access to thousands of third-party apps.

Small companies need to seriously think about making use of Wave. The platform is easy to use as well as provides many of the attributes consisted of in the very best paid accounting software application at a comparable level of quality. Wave Financial might not be as detailed as some audit programs, but it’s still a step ahead of other complimentary accounting software program.

Sage Business Cloud Accounting: Best for Freelancers/Self-Employed in Friendsville, Garrett County

Editor’s rating:

7,5

- Sage lets you create and send invoices, track repayments, as well as instantly fix up bank entries.

- It offers 24/7 support by means of live Q&A talks with experts at Sage, as well as individually sessions with an accountancy expert.

- The software integrates with just one POS system.

Freelancers as well as independent people need an affordable audit program that can help them send out invoices as well as make money. Sage Business Cloud Audit supplies that and also much more, making it our choice for the best bookkeeping software application for consultants and also the freelance.

Sage Organization Cloud Bookkeeping is cost-effective accountancy software program that packs a lot of punch. With the entry-level strategy, you can develop as well as send invoices, track repayments and automatically reconcile bank entries.

Sage has an additional plan that sets you back $25 a month for unrestricted customers. With it, you can send invoices, quotes and also estimates; run records as well as conduct evaluation to anticipate cash flow; manage purchase billings; as well as immediately break and also upload receipts. Sage makes that service cost-free for the very first 3 months, and also the company is presently running a promotion that provides service users 50% off the higher-tier plan for six months.

We also like that Sage offers a totally free 30-day trial. Sage likewise makes it simple to terminate; there isn’t a long-lasting contract that costs extra to break, however you do need to provide the firm development notice of termination.

Another reason we chose Sage for consultants as well as freelance individuals is that it is easy to establish as well as navigate. The software application automates a great deal of the accountancy processes that are normally hand-operated, such as uploading expenditures and also repayments and sending out invoices and tips concerning past-due bills.

Thanks to its assimilations as well as applications, Sage is conveniently expanding as your service expands. The business runs an on the internet application market as well as incorporates with a slew of applications, consisting of AutoEntry, Draycir, Avalara and also Credit Report Canine.

Sage’s customer support is really accessible, which is excellent news for freelancers as well as independent individuals that do not have accounting expertise. If you have inquiries or require help, you can access client assistance 24/7 by conversation as well as live Q&A sessions. Sage likewise offers one-on-one assistance through on-line sessions with Sage audit specialists.

For freelance and also self-employed workers, it’s important to be able to rapidly and also quickly send invoices as well as track payments. With Sage Business Cloud Accountancy, you get a cost effective way to maintain capital, making it an excellent accounting program for consultants as well as self-employed people.

ACCOUNTANCY SOFTWARE PROGRAM PRICING

Accounting software application helps company owner improve invoicing as well as accounting, and also it does not have to cost a lot of money. A lot of programs supply a number of strategies to accommodate your needs as well as budget.

There are usually 2 types of pricing designs for audit software program: continuous licensing or a recurring subscription. With a continuous licensing version, you make a single settlement for limitless access to the software application. With a subscription rates design, you pay a month-to-month or annual cost for accessibility to the software.

For registration rates, anticipate to pay anywhere from $4.99 per month for a basic starter plan to as much as $60 per month for a more advanced solution strategy. Other aspects, like the consisted of functions and also variety of users, will impact the regular monthly expense also.

Despite the prices version you pick, watch out for hidden fees, which can include added costs for customization alternatives, installment or setup services, integrations, as well as maintenance or assistance solutions.

If your organization is on an actually limited spending plan, you may want to think about free accountancy software program. Wave, as an example, offers much of the accountancy and also invoicing attributes you would find in paid programs.

When you’re choosing audit and invoicing software application for your service, we strongly motivate you to make the most of any type of complimentary trials to test out the options and see which one offers the functions as well as tools you require. And also, spending quality time with the software application ahead of time aids you really feel extra certain in your choice.

KEY FEATURES OF ACCOUNTING SOFTWARE APPLICATION.

There are numerous elements of bookkeeping software application that help make it an useful tool. As a small company owner, it is very important to recognize which includes to try to find. The majority of on the internet accounting software provides balance dues, accounts payable, banking as well as reporting functions. Some programs consist of supply monitoring, task monitoring, time monitoring as well as pay-roll devices.

Below are several of the core features to seek in audit software:.

Financial institution Feed

This feature attaches the software to your service financial institution and also charge card accounts to obtain a day-to-day update of your purchases. This saves you time, due to the fact that you will not need to post purchases manually. It likewise offers you a daily, as opposed to monthly, review of your accounts. A real-time bank-feed attribute can assist with reconciliation, permitting you to make it a little day-to-day job instead of a month-to-month experience.

Control panel

When you visit to your account, you’ll be greeted by a control panel that shows you a summary of your account activity as well as vital metrics, such as cash flow, profit and also loss, account equilibriums, costs, accounts payable and receivable, and sales. Some accountancy programs permit you to tailor what you see first by reorganizing the info.

Online Invoicing

If your service sends out billings, the capability to email them as well as approve on-line payments helps you earn money much faster. Some bookkeeping programs incorporate with third-party settlement processors; others need you to utilize their in-house processing solutions. It’s an and also for bookkeeping software application to additionally serve as a billing generator.

Repeating Invoices

With this attribute, you can schedule the system to automatically create and also send invoices for recurring fees, such as registrations. You can select how regularly invoices are sent– daily, regular, monthly or every year– and also indicate whether there’s an end day to the invoicing.

Automatic Settlement Tips

This attribute aids you advise customers concerning upcoming as well as past-due repayments. Some have sample email message that you can use as is or tailor. You can after that choose when you want the tips to be sent out. Some programs provide you the alternative to send out thank-you emails to clients after you get their settlements.

Bank Settlement

Smart settlement devices recognize prospective matches between your financial institution purchases and also the costs as well as invoices you have actually become part of the audit software program, conserving you the hrs it would or else take to sift via your savings account for this information. You can then accept or refute the suggested suits. The very best applications suggest potential suits as you reconcile your accounts, and also a few include a reconciliation device in their mobile apps.

Financial Reporting

Every audit program can generate financial records. However some are more fundamental than others, as well as some need you to sign up for a more expensive prepare for sophisticated coverage. If you need particular kinds of monetary reports, you’ll want to make sure they’re included in the software application and plan you pick. Thorough records can help you analyze your financial data to make enlightened service decisions.

Mobile Apps

Not all audit as well as invoicing programs have mobile applications, yet the most effective ones do. There is, nonetheless, quite an array in the capabilities of mobile apps. Some can just catch receipts for expense tracking, some enable you to develop and send out invoices, and also others have virtually every feature the web-based software does. It’s worth examining if the software application you’re taking into consideration uses a mobile app and also, if so, what features are included in the app that will aid you handle your company while you’re away from the office.

Integrations

The ability to link your bookkeeping software application to various other organization programs you make use of conserves you valuable time because you do not have to manually transfer information from one system to another. Pay-roll, payment handling, POS systems and also CRM software are just a few of the preferred kinds of combinations that are readily available with audit software program. Assimilation with systems you currently use additionally lowers training time for staff members that will use the software.

Tracking for Billable Hours

If you’re an expert or your business expenses clients by the hour, you require software application that allows you to track and also bill your time or that incorporates with the time-tracking program you already use. This is a vital attribute for consultants.

Supply Administration

If you have a retail, e-commerce or circulation business, you need an application that helps with inventory tracking and purchase orders. You might need to sign up for a top-tier plan to get this feature. If you require more advanced inventory attributes, seek software that incorporates with a specialized inventory administration system.

Project-Based Billing

Companies, consultants and also consultants that deal with clients on tasks or jobs need to look for accountancy software that helps them track their jobs’ tasks and budgets. The software should allow you to invoice clients for tracked time and expense them for task expenses.

Support for Several Businesses

Several programs we reviewed allow you add greater than one business to your account, though some business charge added for this ease. Likewise, the types of accounting tools that are necessary to you will certainly rely on the specific requirements of your service. For instance, if you run a little freelance company, project-based payment might be one of the most important function on your listing. Or, if you intend to do some work on your mobile device, a full-featured mobile app might be at the top of your list.

BENEFITS OF BOOKKEEPING SOFTWARE APPLICATION

Handling your finances is vital to the success of your service, and also picking the appropriate bookkeeping software program can make that a great deal much easier. There are a lot of benefits from switching out pen and paper or an Excel spreadsheet for accounting software application. Below’s a look at a few of them.

Improves company

Small companies can’t pay for not to have their financial resources in order. Whether it’s time to pay the tax bill or forecast for the following year, it can be tough to obtain the details you require if you are not organized. Bookkeeping software assists you remain on top of your financial data. It organizes monetary details, shops it in one location as well as automates many time-consuming accountancy processes, thereby releasing you as much as focus on running your service.

Does not cost a fortune

Thanks to cloud-based offerings, the cost of bookkeeping software has boiled down a whole lot for many years. Today, small company owners have a lot of selection: Accounting software program prices vary from free to $350 a month. The size of your organization and your audit needs dictate just how much you pay. However if that regular monthly price means you’ll enhance cash flow, fulfill tax responsibilities and also identify development opportunities, it’s possibly worth it.

Makes certain finest techniques

Taxes become part of running a company, and several audit software application suppliers are aware of that. Thus, they have actually developed programs that compute sales tax, prepare tax return and even file tax obligations without any treatment on your component.

FREQUENTLY ASKED QUESTIONS

Just how does bookkeeping software program work?

Audit software program documents transactions as well as tracks various accounting metrics. You can establish the software application to automatically get economic info from your bank or use a very basic version that may call for manually inputting the information. We motivate you to use software application that automatically receives economic info from your financial institution and also bank card provider to track your organization’s finances. Additionally, many software program solutions save the information in the cloud, so your information will certainly be safe and secure as well as safe if your computer system collisions or you experience various other technical issues.

Which local business bookkeeping system is ideal?

Based upon our research, QuickBooks Online is the most effective small business accounting system. Yet, relying on the particular needs of your service, an additional system might be a far better fit or better value. As an example, if your business provides a service and also sends out a lot of invoices, FreshBooks might be the best selection for you as a result of its robust invoicing attributes. See our best picks above for our specific referrals for various organization dimensions and also requirements.

What do you require from your accounting software program?

You require accountancy software application that tracks the cash moving in and out of your business, with both accounts payable and also balance due attributes. Some software remedies do not include both accounts payable as well as receivable information. Additionally, audit software program should attach to your financial institution as well as credit card accounts as well as instantly download your purchases. If your company is service based, you might require job management tools. If your organization offers items, you may want a bookkeeping option that has inventory administration features. Last, try to find software application services that offer higher advantages by connecting to various other organization applications you currently use, such as your point-of-sale system, consumer connection management system or email marketing software.

Do you need online accounting software application as opposed to audit software program?

For small businesses, the term “on-line accounting software application” is usually compatible with “on the internet audit software.” (However, there is a difference between accountants and accounting professionals.) The most effective on-line audit programs for small businesses have bookkeeping capacities that allow you to tape-record debit as well as credit history transactions, along with bookkeeping attributes that allow you run records as well as evaluate your company’s monetary efficiency. Try to find greater than just a bookkeeping remedy; audit software application must include more detail and allow you create billings and in-depth reports.

Should your audit software application also work as an invoice generator?

It relies on your service. If you produce (or anticipate to produce) a lot of invoices to send out to customers and clients, we suggest that you find a detailed accountancy application with invoice-generating features. Freelancers should think about utilizing bookkeeping software program that can generate invoices.

What does an on-line bookkeeping service do?

On the internet audit solutions can carry out a variety of jobs for active local business owner. Some concentrate on accounting responsibilities, such as going into and classifying transactions, fixing up accounts, and producing financial statements and also reports that you can require to your certified public accountant at tax obligation time. Others supply pay-roll and tax preparation services. Some– such as virtual controllers, primary financial officers as well as Certified public accountants– offer high-level accounting services, like interior audits and economic planning and evaluation.

Just how much should a small business strategy expect to pay for bookkeeping software?

For some small business owners, an accountancy system that tracks expenditures and also sends out invoices is all that’s required. For others, progressed reporting, stock monitoring, and shopping are more vital. The camp you come under will dictate how much you pay for accounting software program. Some audit software options are complimentary, while paid variations can cost as high as $25 per month, per user. The total expense of what you invest will certainly be identified by the intricacy of the software program you select as well as how many workers you want to have access to it.

Should small companies look for particular accounting software application qualities?

Small company owners need to seek accounting software application that is simple to mount, basic to utilize, conveniently integrates with third-party applications, as well as gives a bunch of attributes and performance including invoicing and also stock management. The most effective accountancy software allows very easy cooperation between you as well as your accounting professional.

Why should my business take into consideration altering accounting software program vendors?

When it concerns accounting software, altering is easier stated than done. Besides, you currently submitted all your data into the platform and found out just how to run it. Nonetheless, there are factors to take into consideration a switch, as agonizing as it may be. They include:

Much like you shop your insurance, you need to take a look at what accounting rivals are providing from time to time. If you locate a more affordable supplier that provides the attributes you need, it might be a reason to think about changing.

If your service grows as well as your accountancy software application can no more sustain operations, it may be time for an upgrade.

A guaranteed reason to change bookkeeping software application is if your staff despises it. If they find it tough to utilize, you may want to pay attention.

What business processes have been automated with audit software?

A big factor to use audit software is to automate hands-on processes. That minimizes the possibility of human mistake and quicken audit. In bookkeeping software program, automation is ever present. It’s utilized to extract information from large tax files, create brand-new journal entries, track repayments, send out billings as well as eliminate hand-operated data access.

COMMUNITY SPECIALISTS

When searching for accountancy software application, it is essential to locate a service that not only supplies all the features and also devices you need yet additionally fits within your budget. Candace Galiffa, the creator of NewWay Bookkeeping, said she chose QuickBooks Online since it examined both of those boxes.

Not only does Galiffa feel the software application is cost effective, but it likewise has a variety of crucial attributes that stand apart to her, such as its capacity to connect with financial institutions as well as its invoicing platform.

” At the end of the day, a lot of business owners are on a cash basis, as well as we intend to make service banking as straightforward as feasible,” stated Galiffa. “This really allows local business owner not to miss any deductions.”

QuickBooks’ customer service was additionally a plus to Galiffa. Their reps offered support on using the software application, which made the bookkeeping program much easier to browse.

FreshBooks was the software application of choice for Katie Thomas, CFO of Diamond J Audit. One aspect of the software application she discovers especially attractive is its financial institution settlement procedure. This is a crucial function she tries to find in accounting software, because local business owner receive automatic transaction updates.

However, one problem Thomas had with FreshBooks was the lack of personalization readily available with the software application’s attributes. “As local business proprietors, you desire something that is mosting likely to be easy to use, available as well as can grow with you,” Thomas stated. “Even if you’re a local business doesn’t mean you have to believe tiny. You want something that can adjust as well as something that uses job monitoring.”

Thomas referred to Xero as a reasonable program due to its open API and also project management software program integrations. For Thomas, these attributes deserved stating since they assist make operations extra organized as well as streamlined.

Reduces errors

According to a Bloomberg BNA survey, human error is without a doubt the biggest cause of accountancy and also bookkeeping errors. Several accounting experts point out typical mistakes such as spread sheet errors as well as inaccurate hand-operated entrances. Accountancy software application can assist cut down on these pricey errors by eliminating confusing spread sheet inputs as well as drawing data straight from third-party business apps.

WHAT TO EXPECT IN THIS YEAR

As companies start to go on from the COVID-19 pandemic, it’s clear some functions embraced throughout that time will continue to be made use of. One substantial location is cloud-based software program. With increasingly more businesses permitting workers to continue to work from residence, being able to gain access to vital programs, such as accounting software application, has come to be important.

This demand is aiding drive growth in the accounting software application market. Research Study from Fortune Service Insights predicts the accountancy software program market to hit $20.4 billion in 2026, up from just $11 billion in 2018.

Working from house was the only choice for many individuals throughout the pandemic and will certainly continue to be preferred with employees as well as employers across the globe in 2022. Audit software program vendors are reacting by automating even more aspects of accounting.

We expect an increasing number of bookkeeping software program suppliers to find methods to integrate even more expert system as well as artificial intelligence into their software application in 2022. For example, BlackLine, which makes audit automation software, just recently inked a $150 million deal to purchase AI firm Rimilia, which operates a software-as-a-service platform that streamlines capital as well as collection.

Sage additionally creates that automation in bookkeeping features will come to be increasingly vital as a result of labor shortages. Automated attributes to try to find consist of error detection systems, robotic process automation to get rid of tiresome tasks, and also dynamic allocations and also debt consolidations. Because bookkeeping software program shops documents online, automating information circulations for use in analytics will certainly likewise come to be increasingly prevalent.

OUR METHODOLOGY

To determine the very best accountancy software program for small companies, we spent dozens of hours researching the top applications. Right here is a description of our choice procedure.

Situating the Best Providers

We began our research by asking company owner which accounting software application they make use of, what they love regarding it and also what they think makes it the “ideal” application. We likewise researched popular audit applications that often show up on reliable review web sites, top checklists and company web sites.

Selecting the most effective Services

We then produced a comprehensive listing of audit software program that consisted of the applications we recognized from our study, applications we were currently acquainted with and suppliers that have pitched their software program to us.

We narrowed this checklist additionally based upon various use situations and a large range of requirements, including price, attributes as well as restrictions. As a part of our study, we studied individual reviews, watched tutorials and also took a look at client sources, such as knowledgebases, blog sites and also guides.

Investigating Each Service

Next off, we assessed each program by registering for a trial or demonstration account as well as examining the software program ourselves. This direct experience assisted us comprehend exactly how the features work, whether the programs are worth their cost as well as if the software application truly is as easy to use as the supplier declares it is. To better inform our decisions, we got in touch with each supplier to measure the quality of its client support.

Examining Each Solution

We started with more than 100 audit software on our list; nevertheless, following our study and also evaluation, only 11 made it to our list: Billy, FreeAgent, FreshBooks, Intuit QuickBooks Online, Kashoo, OneUp, Sage One, Wave Financial, Xero, ZipBooks and Zoho Books. Our picks for the leading accountancy software application are QuickBooks Online, FreshBooks, Xero, Zoho Books and Wave Financial.

VIDEO FOR Finest Accountancy Software Program for Local Business in Friendsville, Garrett County

Table of Contents

Toggle